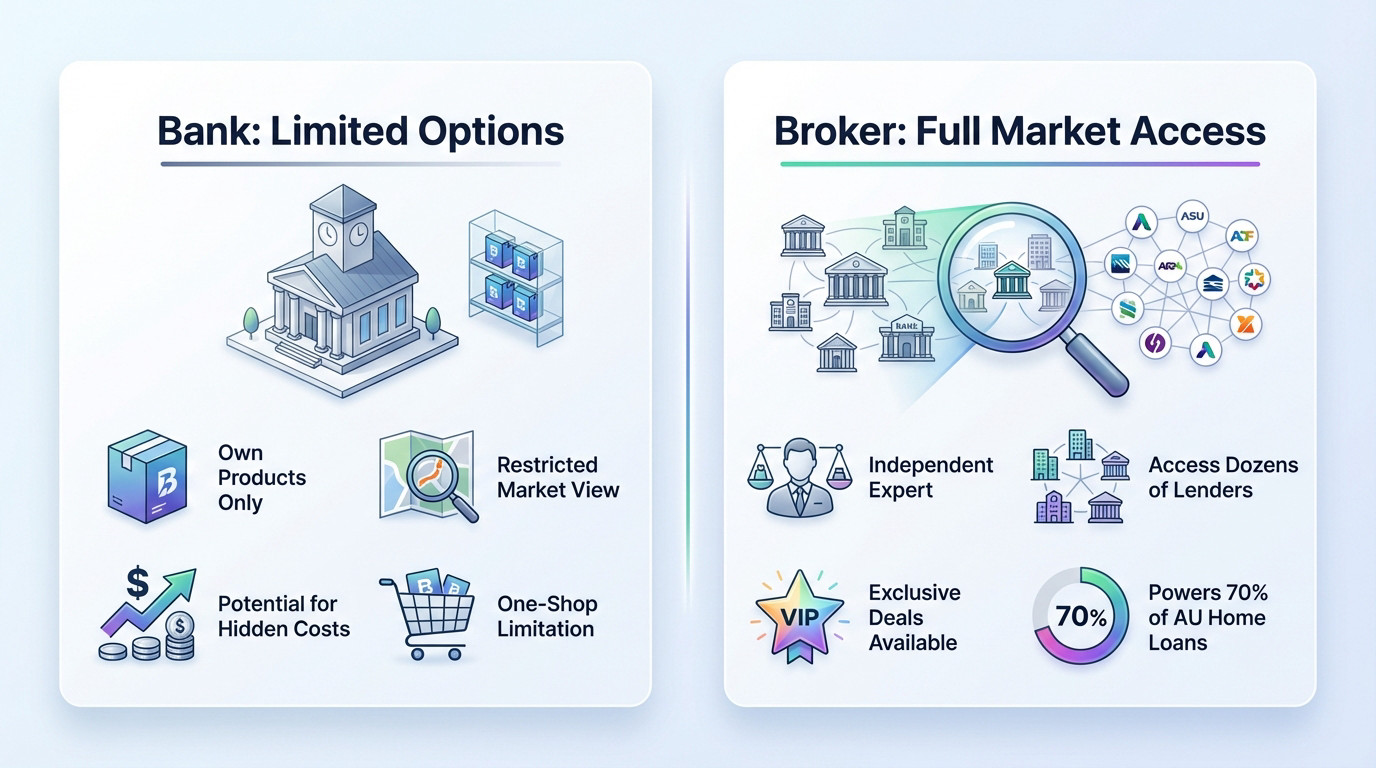

Banks limit options to proprietary products, whereas mortgage brokers scan the entire market to find competitive rates and tailored solutions.

This extensive access simplifies complex applications and maximizes financial benefits without direct costs. Since brokers facilitate nearly 70% of Australian home loans, leveraging independent expertise ensures a wider choice and a smoother settlement process.

When weighing up Banks vs Mortgage Brokers, do you suspect that loyalty to your current lender is actually costing you thousands in higher repayments? This choice determines whether you are restricted to a single product menu or have the power of the entire market working in your favor.

We reveal how independent advice secures superior rates and protects you from the hidden pitfalls of going direct.

The Real Difference: Access and Choice

Your Bank’s Limited Shelf Space

When you walk into your local branch, you are seeing a tiny fraction of the financial picture. That friendly officer can only offer the mortgage products from their own institution, even if a competitor has a significantly better deal available.

This approach might work for simple files or if you love keeping everything in one app, but it is inherently restrictive. It is exactly like shopping for groceries at a store that refuses to sell anything but their own brand.

Unfortunately, that blind loyalty often carries a hidden cost: a less competitive rate or rigid conditions.

A Broker’s View of the Entire Market

A broker flips the script completely. We act as independent experts who scan the market to find the loan that fits your specific situation, rather than trying to sell you a single product.

We work with dozens of lenders—from the big banks to online specialists. This diversity is our main strength, which is why brokers arrange nearly 70% of home loans in Australia. We give you the choices a single bank simply cannot.

This access often includes exclusive offers and policy exceptions that are not available directly to the public.

Banks vs Brokers: A Head-to-Head Comparison

Now that the fundamental difference is clear, let’s examine the practical pros and cons of each option to help you decide. Many buyers assume their current bank will reward loyalty, but you might be missing out on significantly better terms elsewhere. Here is the direct comparison to clarify your choice.

Key Differences at a Glance

Think of this table as your cheat sheet. It strips away the marketing noise so you can compare the two paths side-by-side.

| Feature | Bank | Mortgage Broker |

|---|---|---|

| Loan Options | Limited to one lender’s products | Access to dozens of lenders (banks, online lenders, specialists) |

| Advice | Product-focused, biased towards the bank | Impartial advice based on your needs and the whole market |

| Negotiation Power | Limited, based on standard rates | Stronger, can leverage lender competition for better rates |

| Approval Flexibility | Often stricter, rigid criteria | More flexible, experienced with complex or non-standard applications |

| Cost to You | No direct fee, but potential for higher interest rates | Often no fee (paid by lender), but some may charge a fee for service. AJ Home Loans has no direct cost to you. |

| Ongoing Support | Transactional, often ends after settlement | Long-term relationship, helps with future needs like refinancing. |

What About the Cost? Are Brokers Really ‘Free’?

Let’s be real about the cost. For most residential loans, using a broker service is completely free for you. The lender pays a commission for the introduction, meaning you save money while we handle the legwork.

This commission structure is standard across the Australian industry. It simply means you receive expert advice and market access without paying anything from your own pocket.

For full transparency on our earnings, you can visit our FAQ page to learn exactly how mortgage brokers are paid.

When a Mortgage Broker Is Your Best Ally

Beyond general comparisons, certain situations make choosing a broker not just smart, but practically indispensable for your approval chances.

Navigating Complex Financial Situations

Big banks generally prefer “cookie-cutter” applications where every box is ticked perfectly. If your financial life sits even slightly outside their rigid norms, you risk a swift and frustrating refusal.

This is where we prove our worth. We know exactly which lenders look past the algorithms to support self-employed locals, casual workers with fluctuating income, or folks repairing a credit score. It is about finding the human who understands your story.

We reframe a “difficult” application into a solid proposition by presenting it to the right lender, the right way.

A good broker doesn’t just find you a loan; they build a compelling case for you, especially when your financial picture isn’t straightforward. That’s where we shine.

For First Home Buyers and the Time-Poor

Buying property feels like learning a foreign language, which is frankly overwhelming for first home buyers. Think of a broker as your personal translator and guide, cutting through the confusion.

We handle the mountain of paperwork, communicate with the lenders, and keep you updated, so you aren’t stuck on hold for hours. You avoid the administrative headache while we push the process forward, saving you stress.

For busy Gladstone families juggling work and kids, reclaiming those hours is often just as valuable as the interest rate. Contact an experienced first-home buyers’ mortgage broker to get started.

Securing Specialised Loans

If you need something beyond a standard 30-year mortgage, walking into a branch is rarely your smartest move. Specialised lending requires a broker who knows which niche policies actually fit your specific goals.

We navigate the specific requirements for:

- Construction loans with staged payments.

- Investment property loans with specific interest-only requirements.

- Government-backed loans like the First Home Guarantee.

- Loans for unconventional properties.

You can learn more about our specific support for Construction loans and Investment property loans on our dedicated pages.

When Going Direct to Your Bank Might Make Sense

Look, a broker isn’t always the only answer. There are specific scenarios where walking directly into your local branch is actually a logical move.

You Have a Long and Strong Banking Relationship

If you have been a loyal customer for years with a spotless financial history, your bank already knows you. They have immediate access to your transaction records and ID, which can significantly simplify the administrative burden of the application process.

Banks also fight to keep “sticky” customers. They might offer specific “professional packages” or fee waivers if you bundle your credit card, transaction accounts, and home loan together. Sometimes, that loyalty translates into a slight discount off the standard variable rate.

Your Application is Perfectly Straightforward

Banks absolutely love what we call “vanilla” borrowers. If you are a standard PAYG employee with a consistent income, strong genuine savings, and a clean credit report, you fit perfectly into their automated risk algorithms.

In this specific case, the approval process via a bank can be fast and frictionless. But here is the catch: speed doesn’t equal value. It is still smart to verify if that “easy” approval comes with a rate that is actually competitive.

The Convenience Trap to Watch Out For

The main appeal of the bank is convenience, but that comfort often comes with a heavy price tag. Falling for the “loyalty tax” could cost you tens of thousands of dollars in extra interest over the life of your loan.

Failing to compare options is an expensive mistake. Even if you start with your bank, nothing stops you from consulting a local mortgage broker to validate if that offer is truly the best deal.

Beyond the Application: How a Broker Manages the Entire Process

Obtaining a pre-approval is only the beginning. The real difference often shows in the weeks that follow, when the transaction needs to be finalized.

From Pre-Approval to Settlement

Securing a home loan pre-approval is actually just the starting line, not the finish. You suddenly have to coordinate the lender, your conveyancers, and pushy real estate agents simultaneously to keep the deal alive.

If you go direct to a bank, that coordination headache lands squarely on your desk. You effectively become the conductor, chasing updates while trying to pack boxes.

A broker, however, steps in as your single point of contact to handle that entire messy web of interactions.

The Broker’s Role as Your Project Manager

Your broker makes sure every piece of the puzzle fits perfectly. They relentlessly track your file’s progress with the lender’s underwriting team so you aren’t left guessing.

They communicate directly with your solicitor to confirm all documents are prepped for settlement. If a bottleneck pops up, they are the ones on the phone fixing it before it becomes a crisis.

This level of hands-on support is exactly what separates a full service from a cold, transactional exchange.

A broker’s job isn’t done until the keys are in your hand. We chase the banks and solicitors so you can focus on planning your move.

Why This Matters in the Gladstone Market

In a tight, competitive Gladstone housing market, the speed and reliability of your closing can make or break the deal. A single administrative delay could actually cost you the property.

- A significantly faster, smoother settlement process.

- Drastically less stress and uncertainty for your family.

- Building a reputation as a reliable buyer with local agents.

- Avoiding expensive penalties caused by missed settlement dates.

Deciding between a bank and a mortgage broker ultimately comes down to your specific goals. While banks offer familiarity, a broker provides access to wider choices and expert advocacy. Ready to find the right loan for your needs? Book an appointment with our Gladstone team today.

FAQ

Do mortgage brokers charge fees for their services?

In the vast majority of residential cases, using a mortgage broker is free. Instead of charging you, the broker receives a commission from the lender once your loan is settled. This structure allows you to access expert advice and market comparisons without paying out-of-pocket fees.

However, it is always wise to ask upfront. Some brokers may charge a fee for highly complex commercial loans or short-term financing, but for a standard home loan, their service is typically at no cost.

Can a broker get a better interest rate than a bank?

A broker often has the advantage of choice. While a bank officer can only offer you the interest rates and products specific to their institution, a broker compares options from dozens of lenders, including major banks and smaller, competitive specialists.

This access allows them to shop around on your behalf. They can identify lenders offering lower introductory rates, cashback offers, or better long-term value that you might miss if you only visited one bank branch.

Is it faster to go directly to a bank for a mortgage?

Going direct can seem faster if you have a simple financial situation and an existing relationship with the bank. However, banks often operate on strict business hours and may have backlogs that slow down approval times.

A broker acts as your project manager, handling the paperwork and chasing the lender to prevent administrative delays. For complex applications or first-time buyers, a broker’s ability to anticipate lender requirements often results in a smoother and faster path to settlement.

Do brokers favour lenders who pay higher commissions?

No, professional mortgage brokers in Australia are bound by a “Best Interests Duty.” This is a legal obligation requiring them to prioritise your needs and financial situation above their own potential revenue.

They must recommend a loan that suits your specific goals, regardless of the commission rate. This regulation ensures that the advice you receive is impartial and focused entirely on securing the right outcome for your property purchase.