Disclaimer: This information is general in nature and does not constitute financial advice. Eligibility for grants, guarantees, and loan products depends on individual circumstances, lender policies, and government criteria, which are subject to change. You should seek personalised advice from a qualified mortgage professional before making financial decisions.

Considering buying a home in Gladstone but concerned about saving enough for a deposit? Current market conditions and government schemes may present opportunities you haven’t considered. With median house prices around $565,000 and various government schemes potentially allowing deposits as low as 2% for eligible buyers, some Gladstone residents may find pathways to homeownership sooner than traditional saving methods suggested.

The traditional approach of needing a 20% deposit (approximately $113,000 for Gladstone’s median price) has been supplemented by government guarantee schemes that may allow eligible buyers to purchase with smaller deposits – potentially as little as $28,250 (5% deposit) or even $11,300 (2% deposit) in some circumstances, subject to strict eligibility criteria.

Gladstone’s classification as a regional centre may provide access to specific programs that aren’t available to metropolitan buyers. For those working in local industries, understanding these opportunities alongside disciplined saving strategies could influence your property purchase timeline.

Understanding Deposit Requirements in Gladstone

Real Numbers for Local Properties

To provide context for Gladstone properties in 2025, let’s examine what deposits might look like under different scenarios:

For a property at Gladstone’s median price of approximately $565,000, a traditional 20% deposit would require $113,000. However, current government schemes may allow eligible buyers to purchase the same property with deposits of $28,250 (5%) or potentially $11,300 (2%) for those who qualify for specific programs.

Important: These figures are examples only. Actual requirements depend on lender policies, government scheme eligibility, property types, and individual circumstances.

Different areas of Gladstone present varying price points:

- Family homes in established areas like West Gladstone or Telina typically range $450,000-$650,000

- Premium properties in areas like Boyne Island might reach $700,000-$800,000

- Units often price between $350,000-$450,000

Under current 5% deposit schemes (where eligible), these translate to potential deposits of $17,500-$40,000, though eligibility criteria must be carefully reviewed.

Genuine Savings Requirements

Regardless of your final deposit percentage, most lenders require evidence of “genuine savings” – typically 5% of the purchase price held consistently for at least three months. For most Gladstone properties, this means demonstrating the ability to save and maintain $20,000-$30,000 over time.

Additional costs beyond the deposit include legal fees ($1,200-$2,000), building inspections ($400-$800), and moving expenses. Budget approximately $5,000-$8,000 on top of your deposit for these necessities.

Regional Classification Benefits

Living in Gladstone may provide access to regional-specific government programs not available to metropolitan buyers. The Regional First Home Buyer Guarantee specifically targets locations like Gladstone, though places are limited and eligibility criteria apply.

For qualifying buyers, this scheme eliminates Lenders Mortgage Insurance, potentially saving $8,000-$15,000 on typical purchases. However, eligibility depends on factors including citizenship, income limits, and property restrictions.

Local employment in stable industries may support loan applications, as lenders often view consistent employment with established employers favourably. However, final approval always depends on comprehensive assessment of income, expenses, credit history, and lender-specific criteria.

Government Support Programs (as of September 2025)

Queensland First Home Owner Grant

Queensland offers a $30,000 grant to eligible first home buyers purchasing new properties valued under $750,000. This is a direct payment that reduces the amount you need to borrow, subject to meeting all eligibility requirements.

For Gladstone buyers, this may work well with new developments in areas like Telina, Clinton, and parts of Boyne Island that feature house-and-land packages within the price limit. Local builders may construct properties that qualify for this grant.

Example calculation: Instead of borrowing $565,000 for a median-priced new home, the grant could reduce your loan to $535,000 for eligible buyers, potentially saving approximately $800 annually in interest payments at current rates.

The program currently runs until June 30, 2026, though terms may change. As of September 2025, no income limits apply, though other eligibility criteria must be met.

Stamp Duty Concessions

Queensland has eliminated stamp duty for eligible first home buyers on new properties and significantly reduced it on existing homes. For most Gladstone properties under $700,000, eligible first home buyers may pay zero stamp duty.

Example: A $565,000 existing home previously incurred approximately $16,500 in stamp duty. Eligible first home buyers now pay nothing on properties within the exemption limits.

These changes took effect May 1, 2025. Properties between $700,000-$800,000 may receive substantial discounts for eligible buyers, though most Gladstone family homes fall within the full exemption threshold.

Federal Support Programs

Enhanced First Home Guarantee (launched October 1, 2025):

- May allow 5% minimum deposits for eligible buyers

- Regional price cap of $650,000 covers most local properties

- Eliminates Lenders Mortgage Insurance through government guarantee for qualifying applications

- Strict eligibility criteria including citizenship requirements

Family Home Guarantee:

- May allow 2% deposits for eligible single parents

- Income limits apply ($125,000 annually as of September 2025)

- Comprehensive eligibility assessment required

Queensland’s Boost to Buy Scheme (expected late 2025):

- Proposed shared equity arrangements

- Government may contribute up to 30% for new homes or 25% for existing properties for eligible buyers

- Minimum 2% deposits for qualifying applicants

- Income limits of $150,000 for singles or $225,000 for couples (proposed)

Important: All government schemes have specific eligibility criteria that may include citizenship requirements, income limits, property restrictions, and other conditions. Professional advice is essential to understand your eligibility.

Saving Strategies for Various Employment Types

High-Interest Savings Options

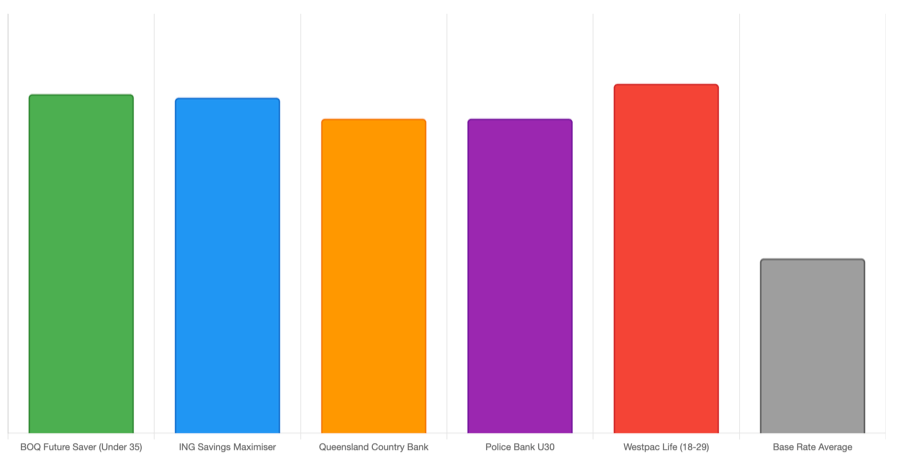

Current savings account interest rates reach 4.8-5.0% for savers who meet specific criteria. However, rates vary significantly between institutions and account types, and expected interest rate cuts may reduce these opportunities over time.

Consider these approaches:

- Research accounts offering competitive rates with achievable bonus criteria

- Compare ongoing rates versus introductory offers

- Consider term deposits for portions of your savings if timeline allows

- Understand that rates change regularly and historical performance doesn’t guarantee future returns

Considerations for Shift and FIFO Workers

Workers in Gladstone’s industrial sector may face unique saving challenges and opportunities:

Potential advantages:

- Higher incomes during work periods may allow accelerated saving

- Direct deposit splitting can automate savings during high-income periods

- Regular roster patterns may support budget planning

Considerations:

- Variable income periods require careful budgeting

- Some lenders may require additional documentation for roster-based employment

- Professional mortgage advice becomes important as lender policies vary significantly

The First Home Super Saver Scheme may particularly benefit higher-income workers, as contributions receive concessional tax treatment (15% tax rate instead of marginal rates).

Banking Relationships

Local banking relationships may offer advantages:

- Regional lenders often better understand local employment patterns

- Credit unions may apply more flexible assessment criteria

- Local mortgage professionals understand area-specific considerations

- Regional lenders may offer competitive construction loan rates for local builders

However, terms, rates, and criteria vary significantly between lenders, making professional comparison essential.

Lender Assessment Requirements

Genuine Savings Evidence

Regardless of government schemes, lenders typically require evidence of genuine savings ability. This usually means demonstrating 5% of the purchase price held consistently for three months minimum.

For a $565,000 Gladstone property, you would need to demonstrate approximately $28,250 in accumulated savings over time, though specific requirements vary by lender.

Acceptable evidence may include:

- Regular savings account deposits over time

- Term deposits held for appropriate periods

- Managed funds or shares held consistently

- First Home Super Saver Scheme withdrawals

Some lenders may accept alternative evidence such as consistent rental payments or regular savings from employment benefits, though policies vary significantly.

Employment Considerations

FIFO and shift workers may need to demonstrate employment stability despite roster variations. Long-term contracts with established employers can support income stability evidence.

Application presentation matters:

- Include comprehensive employment documentation

- Provide pay slips covering various roster periods

- Show consistent savings despite irregular pay cycles

- Consider professional assistance for complex employment situations

Different lenders have varying levels of understanding regarding FIFO employment patterns, making lender selection important for optimal outcomes.

Market Timing Considerations

Economic Environment

Gladstone’s economic base provides stability through diversification across LNG, aluminium, port operations, and agriculture. This diversification may support long-term property value stability, though all property investments involve risk.

Recent infrastructure investment including healthcare, education, and transport improvements may support the region’s long-term prospects, though property values can fluctuate based on numerous factors.

Government Scheme Accessibility

Multiple government programs launching or improving through 2025-2026 may create opportunities:

- Enhanced First Home Guarantee with expanded access from October 2025

- Queensland’s Boost to Buy launching late 2025 (proposed)

- Current First Home Owner Grant extended through June 30, 2026

Important: Government programs can change or be discontinued. Current benefits may not persist indefinitely, and future policy changes could affect accessibility or terms.

Interest Rate Environment

Expected interest rate movements may affect both savings returns and borrowing costs. Current high savings account rates may decrease with rate cuts, whilst mortgage costs may also reduce.

Property prices in regional markets like Gladstone typically show different patterns compared to metropolitan areas, though all property markets involve inherent risks and uncertainties.

Taking Action

Gladstone residents may find current conditions present various considerations for homeownership decisions. Regional classification provides access to specific government programs, whilst local employment may support stable income evidence for lender assessment.

The shift from traditional 20% deposits to lower deposit government guarantee schemes may affect saving timelines for eligible buyers, though individual circumstances vary significantly and eligibility criteria must be carefully reviewed.

Success requires understanding which programs may apply to your specific situation and developing saving strategies appropriate to your employment pattern and financial circumstances. Different employment types require different approaches, and various government schemes serve different buyer categories.

Professional guidance becomes valuable for navigating complex eligibility criteria and lender policies. AJ Home Loans provides local expertise in regional lending markets and can help identify optimal pathways combining government schemes with appropriate lending options.

Key considerations:

- Government support programs have specific eligibility criteria and may change

- Current market conditions may not persist indefinitely

- Individual circumstances significantly affect borrowing capacity and program eligibility

- Professional advice is essential for understanding your specific options

Your next step involves calculating which deposit amounts and government schemes may apply to your circumstances, then developing a savings plan tailored to your situation. For personalised guidance on your homeownership journey, contact our team who understand Gladstone’s market and current program requirements.

Remember: This information is general in nature only. Individual circumstances vary significantly, and you should seek personalised advice from qualified professionals before making any financial decisions. Government schemes have specific eligibility criteria, and lending policies vary between institutions